"Finance for Kidz"

A Series of Financial Books for Kids!

author: Dr. Prakash Dheeriya

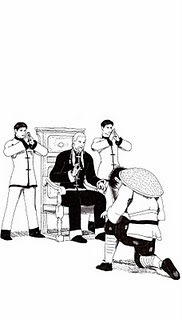

Excerpt: "It was Thanksgiving Day, and the Zrugal family had planned and cooked a feast. Their mom, Mrs. Zrugal, was the main chef. The boys, Zimmy, the older brother and zyler, the youngest, ran around and around helping their mother measure and pour and mix."

Dr. Prakash Dheeriya is a professor of finance at California State University-Dominguez Hills and author of Finance for Kidz, a 20-volume series of books that teaches children about money management, personal finance and planning for the future. www.Finance4kidz.com

Dr. Prakash Dheeriya is a professor of finance at California State University-Dominguez Hills and author of Finance for Kidz, a 20-volume series of books that teaches children about money management, personal finance and planning for the future. www.Finance4kidz.comTop 10 Ways to Incorporate Financial Principals in your Parenting

Compensate your children for extraordinary effort, work or errand done, particularly if they do it without being told. Reward them for positive change in their behavior.

Don’t reward with material things or money for being a member of the family or for doing what a child is supposed to do.

Remember that every moment with your child is a teachable moment. For example, when driving to school, show them the prices on gas stations and explain why they change so often. Explain the prices using concepts of demand and supply.

Take your children grocery shopping. While in a store, tell them they need to buy a cereal box, or some item. Give them money and tell them to pick one and to do it wisely. If they can count money, ask them to complete the purchase transaction on their own. Discuss what they did right and what they can do better next time.

Teach children the value of comparison shopping.

Make use of coupons in their presence. Show them the value of buying in bulk, shopping at garage sales and flea markets.

Take your children to the bank and open a savings account in their name and request an ATM card for them. Once you receive the card, show them how to deposit cash using an ATM. Once in a while, show them how cash is withdrawn. Ask them to keep a running total of their balance.

When paying for a dinner at a restaurant, ask your children who will pay for the meal and how they should pay for the meal – via cash, check or credit card. Talk to them about pros and cons of using a credit card.

Talk to children about identity theft and the importance of protecting personal information from strangers. This can be done while completing a school application form, writing a check or paying for toys in a toy store.

Explain to your children that money is just a tool and they don’t need it to make them happy. It is a means to an end and not the ultimate goal in life. Money is not payment for love or a proxy for love. Money doesn’t guarantee happiness. Teach them the values associated with sharing, recycling and caring for others and the environment. Finally, have them develop a healthy relationship with money, otherwise money will control their lives instead of the other way around.

Prakash L Dheeriya, PhD

Father, Author & Professor of Finance

Finance for Kidz Series

http://www.finance4kidz.com

http://www.finance4kidz.com/testimonials.html

Jumpstart a Lifetime of Financial Wisdom!

http://shine.yahoo.com/channel/parenting/do-you-talk-to-your-kids-about-money-1328708/

http://www.authorexposure.com/2010/05/book-review-finance-for-kidz-series.html

http://www.pvnews.com/articles/2010/02/18/local_news/news6.txt

http://www.pvnews.com/articles/2010/02/26/opinion/opinion1.txt

http://www.dailybreeze.com/ci_14759228

Jumpstart a Lifetime of Financial Wisdom!